Triple constellation: AUKUS in space

Key points

- The AUKUS security technology agreement could be used to bolster the resilience of spacebased assets integral to the civil, commercial, and national security sectors of Australia, the United States, and the United Kingdom.

- Through increased mutual access to critical technologies and improved engagement with commercial operators, the AUKUS partnership can help maintain minimum viable capabilities across each country’s space supply chains.

- The reconstitution of space-based assets may be required in the wake of international security crises. If these assets are rendered inoperable, or cannot be replaced, the results would include catastrophic civil, commercial, and national security disruptions.

Policy recommendations

- The completion of the Australia-US Technology Safeguard Agreement (TSA) should be accelerated to enable US commercial space companies to operate from Australian spaceports and export space launch technology. The recently completed UK-US TSA can be utilised as a framework.

- AUKUS partners should establish mutual spaceport access to support development. For example, NASA’s first ever use of a foreign commercial launch site was integral to supporting the development of Equatorial Launch Australia’s Northern Territory spaceport.

- To ensure each country maintains the ability to reconstitute space-based assets, the AUKUS countries could collaborate more closely to create minimum viable capabilities and resilient supply chains for satellite manufacturing and launch vehicles.

- AUKUS partners should work together to minimise the impact of military strikes or natural disasters on space-based assets, including by building new constellations of low-earth orbiting small satellites. This could bolster their collective resilience by diversifying away from dependency on existing assets.

Importance of space

Our information-based societies are inseparable from space technology, so it is concerning that space is an increasingly “contested, congested, and competitive” domain.1 With over 5000 operational satellites in orbit and tens of thousands more expected to be launched over coming decades, our reliance on space will only increase, as will its importance as a domain for strategic competition.2

Space-based assets provide vital services including Position, Navigation, and Timing (PNT) support for civil, commercial, and national security purposes, meaning every aspect of society is touched by space technology in some manner.

It is essential for telecommunications, weather and climate monitoring, agricultural management, the finance sector, and natural disaster response and recovery.

In recent years the government and commercial sectors have developed greater awareness of space as a potential single point of failure, given that the degradation of access to space or the destruction of space-based assets would have catastrophic effects. Last year, Australia’s Secretary of Home Affairs, Michael Pezzullo, acknowledged the exposure of critical infrastructure to space-based threats.

Secretary Pezzullo encouraged the development of “a space ecosystem that is resilient to both natural hazards, cyber threats and, indeed, physical threats” in order for Australia to “bounce back from adverse and, indeed, at times catastrophic events”.3 However, establishing such an ecosystem is an enormous and complex task that will require international collaboration and cooperation with the private sector.

Once the sole preserve of a few governments, the space industry is now heavily dependent on commercial operators, meaning national security uses of space are increasingly dependent on the private sector. SpaceX operates approximately one half of all satellites in orbit, followed by OneWeb Satellites and Planet Labs. The proliferation of satellites is partly due to improvements led by the commercial launch sector, increasing the profitability of space investment. In 2020, it was estimated that the global space industry’s value reached $424 billion USD, expanding 70 percent since 2010.4

With space increasingly recognised as a strategically pivotal domain of critical technology, its future will mirror that of cyber: trending towards bifurcation in trade and research as globalisation retreats. This will serve to spur an intensification of space competition, which will present risks for civil, commercial, and national security uses of space.

Threat reality

Threats relating to space assets and access include:

- intensifying great power competition in the space domain

- counterspace technologies

- space weather

- collisions as a result of increases to space traffic and related debris.

Great power competition

Though the United States remains the pre-eminent global space power, its dominance of space is being challenged.

Russia and China have been designated as the two greatest threats to the United States and its allies in space, as outlined in a recent Defence Intelligence Agency report.5 Their significant investment and focus on space follows a common objective to out-perform the United States and its allies and to exploit reliance on space-based systems.6 Russia and China’s combined operational space fleets have grown by approximately 70 percent between 2019 and 2021.

The Chinese Government has a strategic approach that considers US dependence on space “its Achilles’ heel”, and is rapidly expanding its capabilities to exploit this.7 The Rosetta Stone for interpreting China’s ambitions for space is its approach to Antarctica and the South China Sea, where it has previously professed a commitment to non-escalatory behaviour while continuing to incrementally expand its presence and assert its claims. Indeed, Ye Peijian, the Chief Commander of the Chinese Lunar Exploration Program, recently compared the moon and Mars to the Senkaku and Spratly Islands, adding that China must protect its “space rights and interests”.

Counterspace technologies

Counterspace technologies can be placed into five categories: direct ascent; co-orbital; directed energy; electronic warfare; and cyber. The capabilities of Russia and China in each category are rapidly evolving. The most totemic counterspace weapon is a direct ascent anti-satellite weapon (ASAT), of which sixteen tests have been conducted by four counties – the United States, China, Russia, and India. The most recent test was conducted by Russia in 2021 and resulted in a debris cloud of more than 1500 trackable pieces.8

However, investment in energy weapons beyond direct-ascent ASAT technologies by all major space players will define the future of counterspace technologies. These energy weapons include high-powered lasers, microwave, and particle beam weapons.9 Attacks from these weapons will be difficult to attribute as damage can be temporary or reversible.

However, in the immediate term, the use of cyber-attacks and radio frequency jammers targeting space infrastructure will remain the most urgent military threat to space systems.

This was witnessed in the lead up to Russia’s invasion of Ukraine, when a series of cyber-attacks against enabling satellite infrastructure successfully targeted communications provider Viasat.10

Collision risk and space weather

In-orbit collision is another risk that is difficult to mitigate. There is a potential for a cascading series of orbital impacts, known as the Kessler effect, that could wreak havoc on all orbiting space assets and potentially render space inaccessible. To address the possibility of a Kessler event, companies such as LeoLabs are tracking new and existing debris down to the size of two centimetres as well as satellite conjunctions.

Space weather can add to potential collision risks by making satellites uncontrollable.

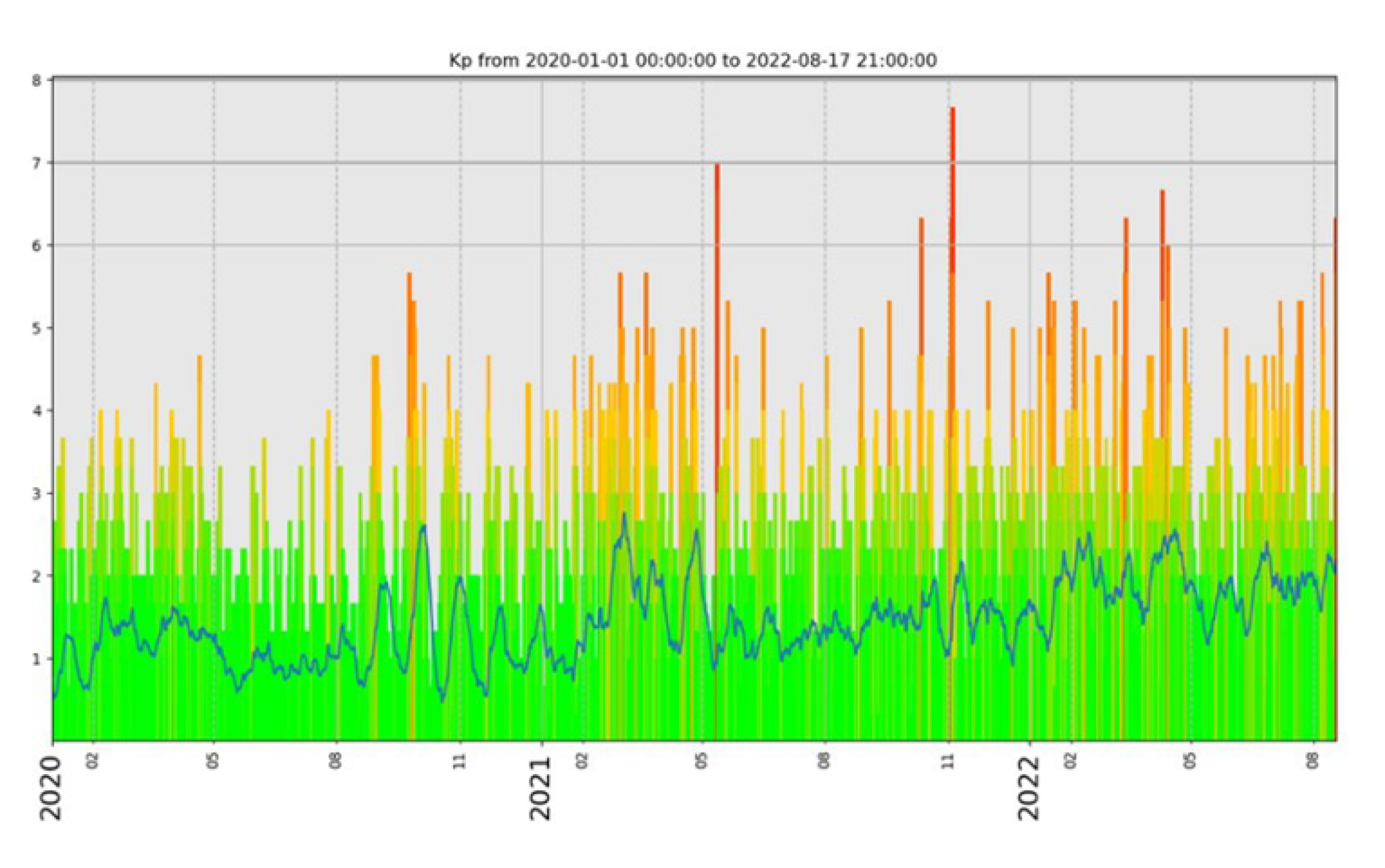

This year SpaceX suffered a loss of 40 satellites during launch due to the impact of a geomagnetic storm caused by the Sun, which generates a high degree of damaging radiation. While the threat of radiation can generally be minimised, there is a limit to what can be done to protect from such powerful geomagnetic storms. The KP Index at Figure 1 shows an increased disturbance in the Earth’s magnetic field from solar weather, with incidents over 6 representing moderate geomagnetic storms.

AUKUS space collaboration

The technology-centric trilateral AUKUS agreement could be used to elevate space cooperation and build mutually beneficial space capabilities.

Space-related momentum can already be seen in agreements on complementary technologies such as quantum computing, artificial intelligence, and hypersonics.

For the United Kingdom, space cooperation and improving interoperability via AUKUS would support its new designation of space as part of its Critical National Infrastructure. The 2022 UK Defence Space Strategy underscored Britain’s desire to be “at the heart of Allied space efforts”, including alongside Australia.11

For the United States, it would profit from the shared uplift in capabilities of its two allies becoming capable of reconstituting mutually beneficial space-based assets in the event of a crisis. This includes Global Navigation Satellite Systems (GNSS) that provide vital PNT services used for all forms of transportation, the finance industry, agriculture, emergency management and more. Additionally, via AUKUS, opportunities can be investigated to improve and streamline space “innovation cycles and co-development processes” for building mutually reinforcing capabilities in times of crises.12 These could include common satellite technologies.

Through AUKUS, steps could be taken to boost space resilience against military or natural crises by ensuring that the countries maintain minimum viable capabilities across key elements of the space industry supply chain. This could include focusing on elements required to reconstitute vital space-based assets, as well as systems for disaggregating and complementing existing capabilities. This process should include AUKUS governments working together to incorporate new and emerging technology firms into the space industry supply chain. Australia is already host to numerous projects that would benefit from such collaboration, such as HEO Robotics, which has developed technology to inspect and identify unknown space-based assets, and Western Sydney University’s development of ‘events-based’ neuromorphic cameras.13 14

Technology Safeguard Agreement (TSA)

The completion of the Australia-US TSA negotiations would help deepen cooperation. Using the recently completed UK-US TSA as a model, this agreement would enable US companies to operate from Australian spaceports and export space launch technology to Australia. It would ensure that US spaceflight technology is properly protected when operating in either the United Kingdom or Australia via a legally binding framework. The lack of a TSA between Australia and the United States is a significant barrier to further commercial activity across civil, commercial, and national security space sectors.15

Under the AUKUS banner, a TSA could be singled out for fast-tracking and would see both Australia and the UK able to more deeply engage world-leading US companies and their technologies.

Spaceports

Promoting the development of spaceports and mutual access via the AUKUS framework will improve both access to space and resilience building. Australia is well-positioned for launch activities by leveraging its geographic advantages and regional accessibility. This year, NASA successfully launched three sounding rockets from an Australian spaceport located in the Northern Territory. Operated by Equatorial Launch Australia (ELA), the spaceport’s proximity to the equator means less fuel is required for launch by capitalising on the earth’s rotation. Other launch sites in Australia include Southern Launch’s Whaler’s Way Orbital Launch Complex in South Australia, which provides access to a variety of orbits including high-inclination orbits. And in 2022, the Morrison Government announced support for the development of up to three new spaceport sites.

The United Kingdom has also moved on both the construction and regulatory approvals for spaceports. There are seven potential spaceport sites across the United Kingdom. SaxaVord, located in the Shetland Islands, aims to host the UK’s first vertical orbital launch this year. Similarly, Spaceport Cornwall and Virgin Orbit are moving fast on plans to launch from the United Kingdom. Commercial viability will have an important role in just how many spaceports end up being constructed in both Australia and the United Kingdom.

Launch vehicles

Beyond spaceports, access to capable launch vehicles will be needed by all three countries.

The Australian Department of Defence’s new Space Strategy notes that, “Defence anticipates it will need access to a responsive and assured space launch capability in the future.”16 The UK Defence Space Strategy also released this year underscores the importance of launch. For Australia, several companies are in later stages of development and harbour greater ambitions, led by Gilmour Space Technologies, but include Black Sky Aerospace and ATSpace. Burgeoning Australian companies are developing innovative capabilities that will support future development. Titomic was a recipient of an Australian Government grant to manufacture and commercialise low carbon emission titanium space vehicle demonstrator parts and Australian company Hypersonix are leading on the development of hypersonic technology and scramjet engines.17 18 The UK Space Agency, like the Australian Space Agency, has sought to foster growth through new regulatory and licensing approaches for launch vehicles; supporting companies like Orbex, Virgin Orbit, ABL Space Systems, and Syrora.19

Satellite manufacturing

The United States and United Kingdom maintain globally leading satellite manufacturing capabilities.

However, all three countries should ensure the ability to support higher rates of commercialisation in the burgeoning small satellite manufacturing industry. For Australia particularly, competing against established satellite producers needs to be carefully considered.

Instead, investment in the ability to manufacture small satellite constellations would meet local demand while servicing an expanding segment of the global space industry. Australia has some emerging companies already, including Fleet Space Technologies, which have six satellites in orbit and others at varying stages of development, like Inovor Technologies, Space Machines Company, and Skykraft. As noted earlier, commercial firms are the largest operators of satellites, but as planned satellite constellations and fillings boom into the tens of thousands, launch infrastructure and supply chains will be increasingly strained. Recognising this, the Morrison Government moved to fund the creation of space-focused collaborative manufacturing hubs through the Modern Manufacturing Initiative Collaboration stream, funding which has since been greenlit by the Albanese Government.

Conclusion

The AUKUS partnership can be used to minimise the impact of a crisis, from conflict or natural disaster, on space infrastructure. By expanding complementary low-earth orbit small satellite constellations; streamlining mutual access to launch facilities; and bolstering each other’s domestic space manufacturing capabilities, the AUKUS partners could strengthen the resilience of their space-dependent societies. These initiatives can be supported by better coordinating trilateral investment in new and emerging space-related technologies.

References

- https://press.un.org/en/2013/gadis3487.doc.htm

- https://www.esa.int/Space_Safety/Space_Debris/Space_debris_by_the_numbers

- https://www.homeaffairs.gov.au/news-media/speeches/2021/29-november-southern-space-symposium-2021

- https://www.spacefoundation.org/2021/07/15/global-space-economy-rose-to-447b-in-2020-continuing-five-yeargrowth/

- https://www.dia.mil/Portals/110/Documents/News/Military_Power_Publications/Challenges_Security_Space_2022. pdf

- https://www.airuniversity.af.edu/Portals/10/CASI/Conference-2020/CASI%20Conference%20China%20Space%20 Narrative.pdf?ver=FGoQ8Wm2DypB4FaZDWuNTQ%3d%3d

- https://www.rpc.senate.gov/policy-papers/threats-to-the-us-in-space

- http://politics.people.com.cn/n/2015/0305/c70731-26638965.html

- https://www.forbes.com/sites/davidhambling/2020/07/24/us-and-uk-accuse-russia-of-testing-in-orbit-anti-satelliteweaponry/?sh=27e56e8c3f3e

- https://swfound.org/media/207350/swf_global_counterspace_capabilities_2022_rev2.pdf

- https://www.ncsc.gov.uk/news/russia-behind-cyber-attack-with-europe-wide-impact-hour-before-ukraine-invasion

- https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/ file/1051456/20220120-UK_Defence_Space_Strategy_Feb_22.pdf

- https://www.aspistrategist.org.au/boosting-space-capabilities-through-aukus/

- https://www.australiandefence.com.au/defence/cyber-space/wsu-camera-tech-captures-world-first-data-from-iss

- https://www.heo-robotics.com/

- https://www.spaceindustry.com.au/tsa-letter-may-2022/

- https://www.airforce.gov.au/our-mission/defence-space-strategy

- https://titomic.com/titomic-awarded-2-325-million-mmi-grant-for-space-based-applications/

- https://hypersonix.com.au/hypersonix-launch-systems-awarded-a8m-mmi-defence-grant-for-the-manufacture-andlaunch-of-3d-printed-dart-ae-technology-demonstrator

About the series

NSC's Policy Options Papers offer concise evidence-based recommendations for policymakers on essential national security issues. Papers in this series are peer-reviewed by a combination of expert practitioners and scholars.